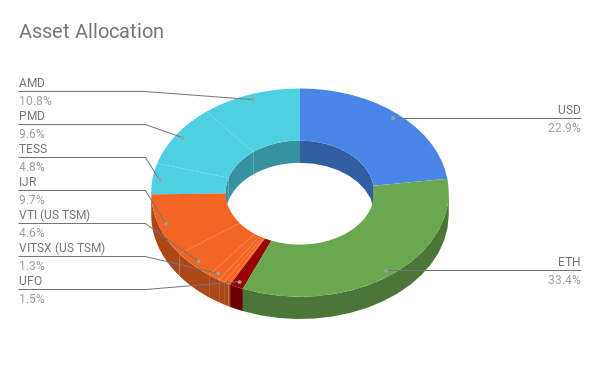

As of July 25, 2020, my liquid next worth stands at about $55,500. My average monthly spending has decreased to below $2000.

A lot has changed since the last update to this blog—I’m speaking, of course, of COVID-19.

I left New York in March and came back to Washington state to ride out the pandemic with my family. Since then, I’ve been working remotely. The second wave of COVID has come as no surprise given the delayed and halfhearted response to the pandemic in the U.S., and so even as things are going back to normal in other developed nations, we languish in a state of partial shutdown—and remote work continues.

I feel incredibly fortunate to be able to work remotely from the safety of my childhood home while everything in the country seemingly goes to hell in a handbasket. And work I have, as I have become much more integrated into the company since the last update and therefore find myself regularly working 10 hour days. On Friday, my boss asked me to put together a report of how much time I allocate to various tasks at work, as the new head of the department wants this data from everyone to do… something or other. This made me wonder about what working hours are considered normal at the company, so I asked him how much he works on average per week. He said 50-60, and some people on the team put in even more.

Oh my God. Is this normal?

Before this I’d asked some of the people I’ve gotten closer to on my team how much they work on average, and their answers vary but are all some variation of “too much.” Yet even as they complain about being overworked many of them seem to take a sort of pride in working this hard—of somehow being martyrs for the cause. Of course, in this case the cause is ultimately to further line the pockets of the already extremely wealthy.

But maybe I’m too cynical.

Regardless, there seems to be an unhealthy acceptance and even quiet celebration of working ridiculous hours at Finance Firm. I suspect that at least a part of this might be able to be attributed to East Coast work culture, and I imagine that the situation would likely be similar at any other financial firm in the city.

Even as I become more comfortable in my workflow and with my coworkers, this further cements the awareness that this isn’t something that I want to be doing forever. But the work experience is invaluable, the name of the firm on my resume will no doubt open doors, and most importantly, I am making more money than I ever have before, by a significant margin.

After completion of my 6-month probationary contract at the beginning of this month, my base salary was increased from $55k to $62k. My position is eligible for OT paid at 1.5x, and I’m glad for that as my average working hours per week have inflated to 50. Given this, I ran the numbers on my expected income over the course of a year if everything remains constant:

Base salary: $62,000

10 hours OT / wk over 52 weeks: $23,250

401k match: $7,440

Expected year-end bonus: $10,000

Total compensation: $102,690

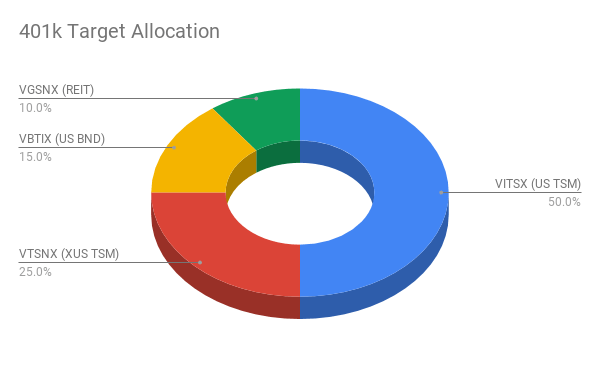

Not bad at all. After the maximum 401k deduction (at $19,500 for 2020) and subtracting taxes, I should have a net salary of $53,725. Assuming living expenses of $27,600 per year (as calculated in the previous update), $26,125 is left to contribute to my Roth IRA and taxable brokerage account. Adding back in my 401k contribution plus employer match, that leaves $53,065 saved over the course of the year. Plugging this savings rate and FIRE net worth target into this very handy tool, I should hit my FIRE target of $800,000 in 6 to 14 years—which would be ages 32 to 40.

Of course this assumes a lot of things—that my salary only grows with inflation, that I work the same amount of overtime, that my spending habits remain the same, that I stay at the same job with the same benefits, etc., etc.

But I do find it helpful to run these numbers, both because I am a nerd for financial planning and because it gives me an indication that I am on the right path.

I do wonder when the impact of COVID-19 will be reflected in the market, if ever—the performance of the major indexes seems to be decoupled from reality at this point—though I do understand that FAANG and related stocks have been far outperforming the rest. Indeed, FinanceFirm is also performing extremely well these days.

This uncertainty does make me nervous, but I have to remind myself that sticking to my strategy and consistently contributing to my investment accounts regardless of market conditions is the only reliable way to achieve FIRE. Either the market will recover after a downturn and go on to reach new highs as it has done every single time before, or world economies irreparably collapse—in which case I will likely have bigger problems than the size of my retirement stash.

So for now, I’ll keep doing what I’m doing, moving closer to FIRE with each paycheck.