As of February 12th, 2020, my liquid net worth stands at $34,000.

My current monthly expenses average $2,300, which works out to $27,600 per year.

Assuming a 3.5% safe withdrawal rate (SWR), which is somewhat more conservative than the 4% suggested by the Trinity Study, my FIRE number is about $788,500. Let’s call this $800,000 to make things easy. Note that this number is in 2020 dollars; after inflation, it will be correspondingly higher.

As of January 2020, I have a 401k for the first time. I am contributing 30% of my pre-tax income (currently $55,000), and with the company match, I am getting an effective contribution rate of 42%. The company match fully vests after 4 years, though, which is either an indication that I need to be more conservative in my projections, or an encouragement to stick it out at FinanceFirm for at least this amount of time!

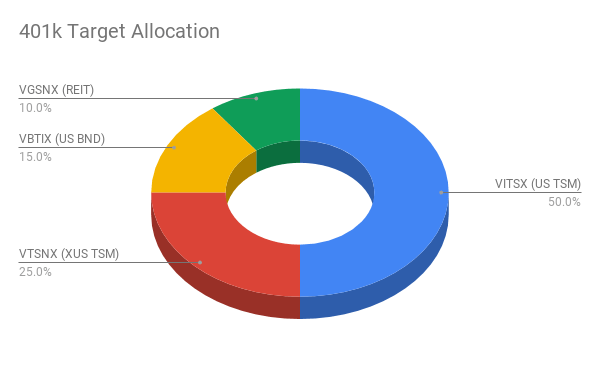

I’m very fortunate that FinanceFirm’s 401k plan is through Vanguard and offers access to Institutional shares, which have very low expense ratios. The asset allocation that I’ve settled on for my 401k is a variation on Rick Ferri’s Core Four portfolio, with the following holdings:

50% VITSX (Total US Stock Market)

25% VTSNX (Total Ex-US International Stock Market)

15% VBTIX (Total US Bond Market)

10% VGSNX (US REIT)

Because I love charts and spreadsheets, here is a visualization of the above target allocation:

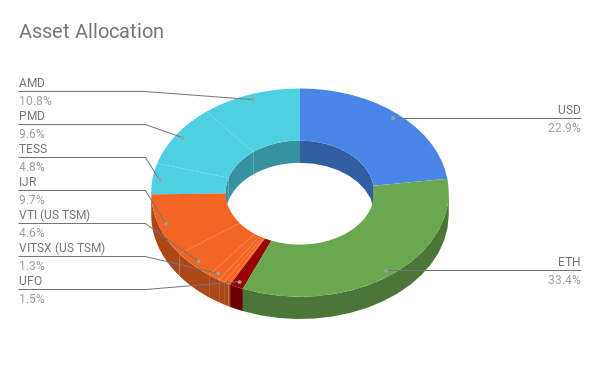

However, because until relatively recently I haven’t had much idea about the right way to go about investing for the long haul, my current liquid net worth looks more like this:

Green is Ethereum, dark blue is cash, light blue are individual stocks, orange are broad index funds, and red is UFO, an ETF which tracks space tech companies.

Suffice to say, my current portfolio is a bit of a mess. As you can see, the cryptocurrency Ethereum currently makes up a full third of my total net worth, and the majority of my equity holdings are in individual stocks (to be honest though, I got VERY lucky on AMD and Ethereum).

All things considered, it might be time to derisk my portfolio.

I intend to continue to contribute 30% of my income to my 401k. This gives me a little buffer in case I go over $2,300 per month in expenses, and at the end of each year I intend to put any overage into my Roth IRA.

Assuming that the ONLY money I save per year is through my 401k and that the savings rate, company match, and my income remain the same ( adjusted for inflation), I will achieve FI in between 14 and 23 years—this is based on the very handy website https://portfoliocharts.com/. That puts me at between 40 and 49 years old. On target!

Of course, as with all things, every one of these factors is subject to change. But I hope to be able to look back at this someday as a reference point for the beginning of my journey.